Approved contributions

Our experts welcome the majority of cars and trucks, trucks, vans, fleet vehicles, trailers, boats, motorcycles, and RVs, contingent on approval. We have customer service reps waiting to respond to any issue you should have for example: "what you are able to donate?" as well as "what state of cars are really taken on?" Please call us toll free at: (888) 228-1050

What records are documentation is necessary?

In almost all cases In Most of the times we will most likely require the title to the car, but every single state has its own unique conditions. Even with the condition that you do not get hold of title form, phone us anyway; different options may be used in a lot of circumstances in many cases. You may connect with us by phoning us toll free at: (888) 228-1050

We appreciate your vehicle donation, and our experts really want to help make that possible for you. If you have other issues, you may explore our vehicle donation FAQ. Our agents are waiting on the telephone, ready to serve to help you pinpoint any paperwork you are in need of to donate your motor vehicle.

Will I have the chance to snag a tax deduction?

That's right, vehicles donated to certified not for profit organizations are undoubtedly tax deductible. Given that we are a 501( c)( 3) non-profit organization, your auto donation to Driving Successful Lives is positively tax deductible. After we receive your car donation, we will mail you a receipt that states your tax deduction amount.

In general, if the motor vehicle you give sells for less than $five hundred bucks, you can claim the fair market value of your auto up to $500. If your donated car yields more than $500, you may have the ability to claim the true amount for which your motor vehicle sold. Learn more about how the IRS allows you to claim a tax deduction for your car donation on our IRS Tax Information page.

Your vehicles donation to an IRS authorized 501( c)( 3) charity is still tax deductible more info and will likely fall under a single one read more of these particular classifications:

1. Concerning vehicles peddled for lower than $five hundred, you may declare the just price right up to $500.00 without needing any additional paperwork. The first tax receipt will definitely be forwarded just after motor vehicle has been validated picked up.

2. In the case that the entire earnings from the sale of your donated car go Car Donation Royal Palm Beach FL over $500.00, your deduction will be set to the real final sale price. You will also be asked by the donee organization to provide your Social Security for the purposes of completing its IRS Form 1098-C form.

Our staff will present you with a letter articulating the final selling price of your automobile within thirty days of its sale.

Will you provide totally free pick-up?

By all means, we will definitely pick up the automobile functioning or otherwise totally free, from a locality that is advantageous for you. If you fill out our online donation form our team will get in touch with you the exact same or following business day more info to schedule your car pick-up. If you make your car donation through calling us at: PHONE. We will definitely arrange for your pick-up then.

Who exactly benefits?

Our vehicle donation system benefits local charities that assist children and families looking for here food & shelter. Your automobile donation really helps make ambitions come true in a range of methods-- including xmas gifts.

We will also render financing to associations that help Veterans.

Your car or truck donation benefits disabled USA veterans through raising loot to provide capital for multiple programs to serve to take care of their necessities.

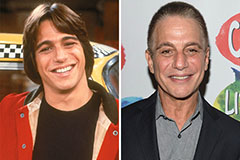

Tony Danza Then & Now!

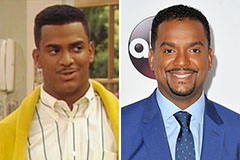

Tony Danza Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!